In a normal year, annual brand planning efforts are in full swing by August. But 2020 has been anything but usual, as it’s constantly rewritten the norms of consumer behaviors and forced marketers to move with a fluidity that makes many of us feel twitchy. Beginning your planning efforts for next year may feel a bit like throwing a fistful of grass into the air, just to see which way the wind is blowing.

While phrases like the “new normal” or the “next normal” have become overused and onerous, the truth is, things are different—and they will be for a long time. The effects of the pandemic on the broader economy and our own individual mental health, the continued fight for racial and social justice, and an unprecedented level of political divisiveness during a Presidential election year, have collectively created big, lasting shifts to consumer behavior.

Looking through these five lenses will do more than guide your annual planning efforts for 2021—doing so will also help you to identify new opportunities for your brand to better serve its constituents, while ensuring relevancy and impact.

First, what makes a new behavior become ‘sticky’ for a consumer?

2020 has forced consumers to try several new behaviors, new brands, and new approaches to purchasing. Some of those changes will stick around even as life normalizes further.

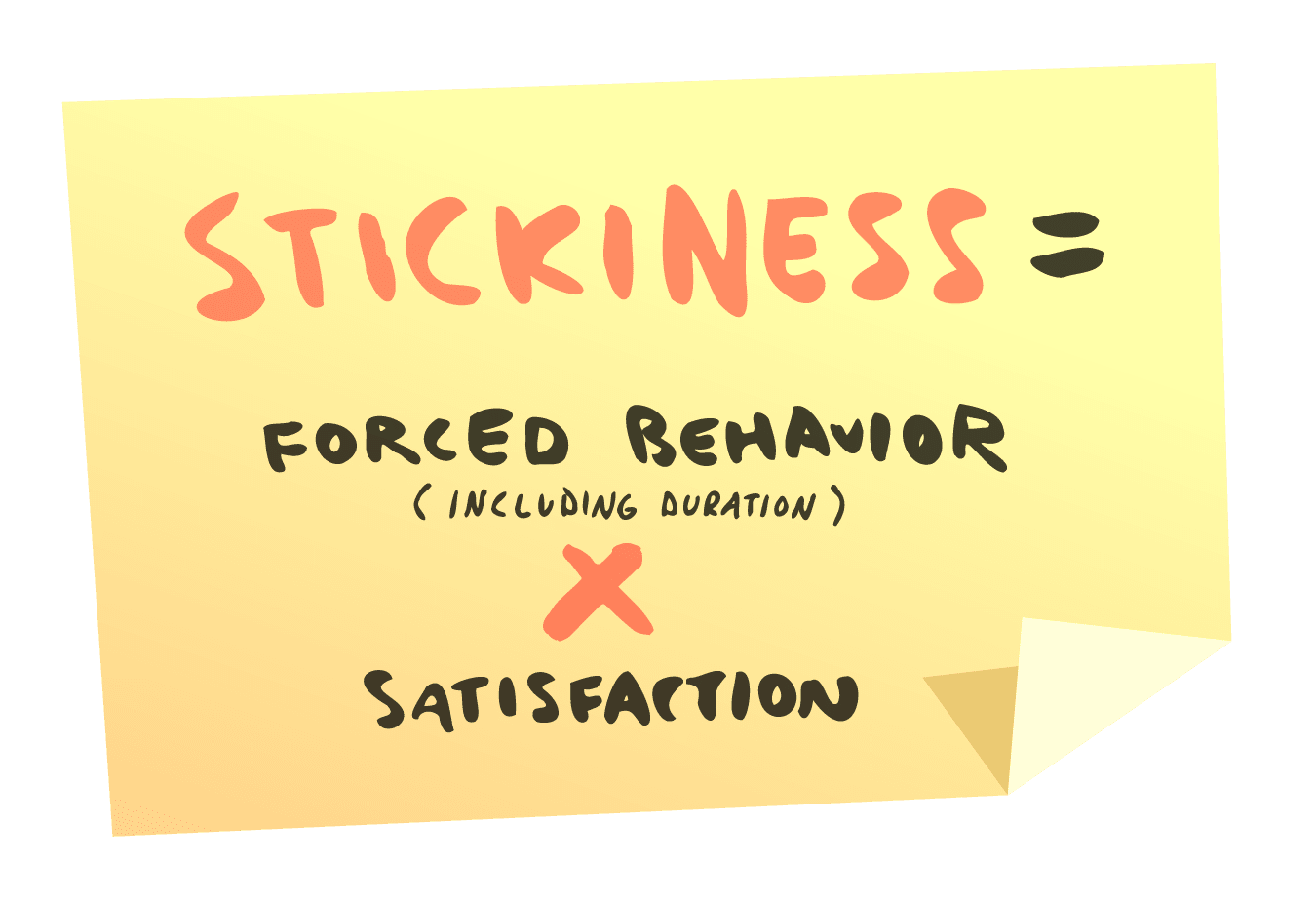

McKinsey has a very simple framework to evaluate which behaviors are most likely to become sticky:8 the longer we’re forced to accept a new behavior, coupled with our level of satisfaction with it, the more likely we continue it for the long-term. Here are five of the stickiest new consumer behaviors.

1. Home as headquarters

Home isn’t just home anymore—over the last several months, it’s become our entire multifunctional universe: Office. Coffeeshop. Cinema. Bar and restaurant. And gym (for some of us, anyway). Our homes have turned into a campus, of sorts, forcing us to divvy up separate areas for competing Zooms (wait, we both have a call at 10am?), or to think differently about our furniture and technology choices to better meet the needs of professional and social lives both largely lived at home.

Even as government agencies push us toward reopening our economies, the reality is that 73% of Americans remain hesitant to resume regular activities outside of the home.1 They’re concerned about visiting gyms, hair salons, and restaurants, and activities like air travel, ride sharing, and public transit are all but removed from their consideration. Home will remain our headquarters for the foreseeable future: the majority of consumers are waiting for milestones beyond government entities lifting restrictions; they’re awaiting medical authorities to voice their approval, more stringent safety measures to be put in place, or a vaccine/treatments to be developed.1

Working from home

Before the pandemic, Americans have slowly grown warmer to working from home. Between 2005 and 2018, the number of people working from home grew 173% to 5M people—which sounds impressive, until you realize that that’s just 3.6% of the workforce.2

Between December and the end of March, Zoom saw an increase of 20× in participants—from about 10M daily users to 200M,3 most of whom were now Zooming from home. (For context, the U.S. population in 2019 was 328M.) Because so many have been forced to WFH without seeing our productivity plummet, experts estimate as much as 25 to 30% of the U.S. workforce will continue to work remotely in 2021.4 That’s a nearly 10× increase in WFH stemming entirely from the events of 2020.

Eating from home

In the first weeks of the pandemic, searches that included the phrase “take out” on Google increased 285%. Likewise, search interest for “food delivery” increased 100%.5 Chipotle saw its digital sales grow 103% in the first month of lockdown and has since increased its focus on opening new locations with Chipotlanes—its drive-thru specifically designed for digital order pickups.6 As late as August, the research group, Savanta, found that the single shopping category with the greatest increased spend continued to be “ordering takeout or delivery.”7

While some QSR and local restaurants have actually grown business, most have suffered during the coronavirus crisis. Many LSRs, FSRs, and independent restaurants are trying to quickly pivot their business models, offering curbside pickup, free delivery, family-style meals instead of single entrees, or even meal kits to make at home. That last offering might be a wise addition, as more Americans are returning to cooking and experimenting with recipes. In June—or month four of the lockdown—more than 40% of consumers said they expected to spend more time cooking over the next two weeks.1

Staying close to home

People are largely staying close to home for socialization, too, with the rise of driveway or neighborhood happy hours. A similar behavior: choosing one’s core squad and keeping it closed off to outsiders to reduce risk of transmission.

Not surprisingly, McKinsey found an 80% reduction in international travel spending8 and an increase in domestic tourism, particularly within one’s home state or region. Those who are leaving their homes are more reliant on their own forms of transportation. 28% of people who regularly use public transportation said they’d do so less frequently, with another 20% vowing to stop riding busses, trains, and subways altogether.9 Similarly, in an IBM study, more than half of the consumers surveyed said they’d either reduce or stop using rideshare apps and services.9 With fewer people in motion on America’s freeways, in metro areas, or moving through transit hubs, brands are naturally pulling back on OOH and experiential activations.

Ultimately, all of these behaviors contribute to the broader trend of home as headquarters—and they all open new opportunities for brands to serve consumers in their multifunctional nests. Brands should look for ways to contribute to or improve upon the headquarters in some way, or to bring elements of their brand experience into the home.

2. The new table stakes to address: Value, availability + convenience

Value

In the 10 years since the Great Recession, the economy has seen a booming stock market and record-low unemployment numbers. However, median household income only increased 1% in the decade,10 putting many Americans in a precarious financial situation even before the coronavirus crisis.

For many, the economic impact of Covid was immediate. In fact, the unemployment rate rose higher in the first three months of the pandemic than it did in two full years of the Great Recession (2008 - 2010).11 At its peak in April 2020, the unemployment rate reached a staggering 14.7%.12

Beyond that, the University of Chicago estimated that an additional 4M Americans, many of them white-collar professionals, had their pay cut during the pandemic.13 All of this is having a lasting impact on driving consumers to reevaluate their spending—even those who are more financially secure. Nearly 1 in 3 Americans report that they will take steps to spend less money after the pandemic than they did beforehand.7 Consumers will be more focused on satisfying immediate needs and on minimizing purchases of non-essential items. They’ll also be more motivated by expressions of value. For instance, between the third and fourth weeks of March, search interest in “free trial” increased 30% on Google.14 Burger King recently tapped into this sentiment with the Pay Cut Whopper promotion, offering people a discount equal to the rate of pay cut they endured.

Availability and convenience

An immediate behavioral change in March was making fewer shopping occasions, with bigger baskets. In other words, people stocked up. (Let us never forget the Great Toilet Paper Shortage of 2020.)

Perhaps a little less dramatic than the TP sitch, it was common within the first few months of the pandemic to have difficulty finding flour, gardening supplies, and even propane tanks for gas grills—all indicating shifts in how consumers were choosing to use their additional time at home.

With people trying to minimize how often they visit stores or how much time they’ll spend in them, it’s become much more commonplace behavior to inquire about availability, over the phone or digitally. 67% of U.S. consumers said they now plan to confirm online that an item is in stock before going to buy it.15

In some categories, messaging around convenience will go a long way in attracting consumers to your brand. Searches for “available near me” have grown on Google by more than 100% YoY.15 Additionally, Mintel predicted that QSR brands will experiment with more app-based subscription programs to really dial up expressions of convenience and value. Both Panera and Burger King dipped their toes in this water by launching coffee subscriptions in the last year.16

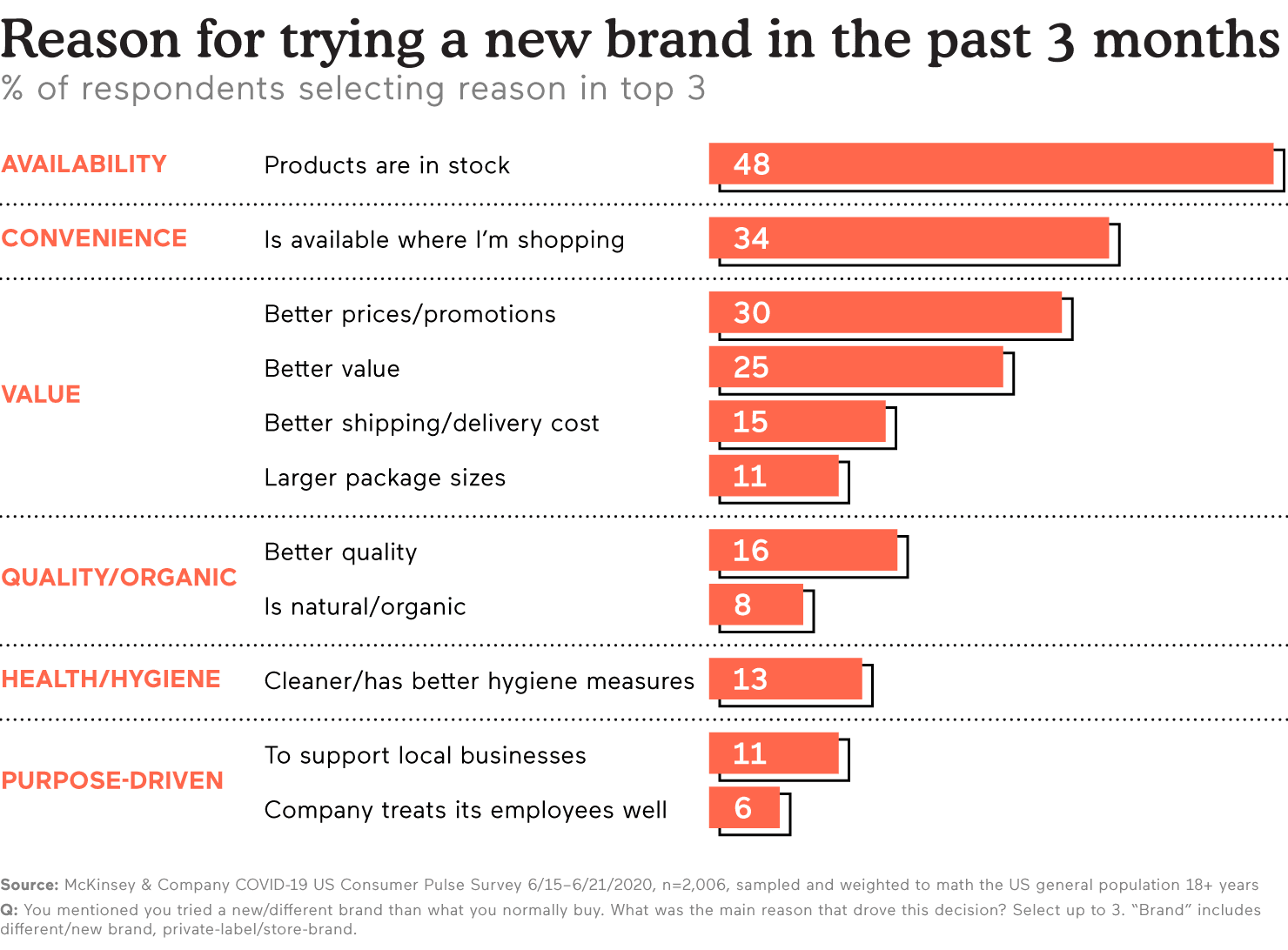

The rise of disloyalty

Driven largely by one of these factors—limited value, availability or convenience—Americans are much more likely to try new brands, retailers, or modes of purchasing. About 20% of U.S. consumers have switched brands during Covid-19, and of those people, nearly three-quarters of them intend to stick with the new brand after lockdown.1

That’s a massive shift in loyalty. As a marketer, this should either terrify you or have you standing up and looking for someone to high-five—depending on which side of the equation your brand finds itself. Regardless, it reinforces a need for enhanced focus on smart and distinctive loyalty/rewards initiatives in 2021—either to stem the flow of people turning their backs on your brand, or to foster excitement and deepen the relationship with your newest customers.

3. All digital, everything

While U.S. consumers—particularly younger and multicultural audiences—have long embraced digital channels, the pandemic represents a real tipping point, bringing many Americans to try digital channels for new activities for the first time. From meals, to news and entertainment, to education, to fitness, to healthcare, 2020 has forced us to embrace low-touch digital channels like never before.

Want proof? Look at the success of Disney+. It reached 50M subscribers in just five months. That same milestone took Netflix seven years to reach.17 And the viewership for Disney+’s marquee event—the July launch of Broadway sensation, “Hamilton”—constituted the single, largest audience amassed by any one program over the course of one month across any programming on Disney+, Netflix, Hulu, Prime Video, and Apple TV+.18 Maybe even more demonstrative of consumers’ willingness to embrace new digital entertainment, Fortnite hosted a live, in-game concert with musician, Travis Scott, and 12.3M concurrent players joined to watch.19

In healthcare, the concept of telehealth has long been established… and largely ignored by American consumers. Not anymore. During the pandemic, nearly 1 in 4 Americans have tried a telehealth appointment for the first time. Nearly a third of Gen Z and Millennial consumers, specifically, have adopted telehealth more firmly since March.20 Indeed, McKinsey reported that the telemedicine industry grew 10× in just a 15-day period this spring.8 The stock performance for Teladoc Health, the leading virtual care technology platform, suggests that investors expect consumers to stick with telehealth over the long-term: TDOC’s purchase price rose 186% between January 2 and August 4.21

How about online grocery shopping? Prior to the pandemic, online grocery sales accounted for about 3% of total grocery spend with an estimated 10% of consumers using online grocery services frequently.22 By the end of March, 31% of U.S. households had used an online grocery service and 26% of those surveyed said it was the first time they had done so.23 And in an indication that this behavior will indeed stick, Walmart and Instacart recently teamed up to help both parties compete against Amazon’s Whole Foods and Prime offerings.24

Naturally, Covid will have an impact on how people shop for the holidays, too. 75% of people who plan to holiday shop said they’ll do more of it online this year. And more than a third of shoppers who historically shop in-store on Black Friday said they’ll stay home.15

As consumers become more universally comfortable with simpler, low-touch or contactless digital interactions, they’ll expect more of them from the brands they support in the future. Is your brand planning to do everything possible to meet this expectation in 2021?

4. Yearning for escape and comfort

With travel plans canceled, constant negative news cycles, uncertainty around any consistent return of college and professional sports, and limited physical connection, it’s natural for us to yearn for escape. But our escapism has taken new forms.

Stress baking, and in particular, a rekindled love with the comfort of great bread. (Here in San Francisco, that’s prompted neighbors to share their sourdough starters communally.) Gardening, which resulted in March being the single most successful month for seed producer, W. Atlee Burpee & Co., in its 144-year history.25 Pet adoption, which wonderfully resulted in many shelters reporting empty or near-empty kennels this spring.26 Video games, with 43% of consumers saying in April that they were either playing more or started playing for the first time ever.27 Outdoor recreation, which saw huge spikes in demand for camping reservations, campervan rentals, and state park visits.

Even some big-ticket purchases that you might expect to perform poorly during a moment of such financial uncertainty performed very well, including high-end Mercedes Sprinter campers and BMW Motorrad motorcycles. In fact, June 2020 was the best-ever sales month for BMW Motorrad.28

So what do motorcycles, camping, video games, gardening, stress baking, and pet adoption have in common? Not a damned thing—except that they all fulfill a very real and basic need for people now: to provide escapism and comfort. And in a world without physical touch, or the ability to travel long distances, or even to share space with our loved ones, that need has never been more prominent. For brands in 2021, this presents an opportunity to reframe narrative, tone, or imagery to better address these basic needs.

5. Brands that do good will do best with the new consumer

This isn’t about purpose marketing (or the debate in the industry on whether purpose marketing is bullshit or not). This is about a shift in how people will evaluate brand choices for the foreseeable future.

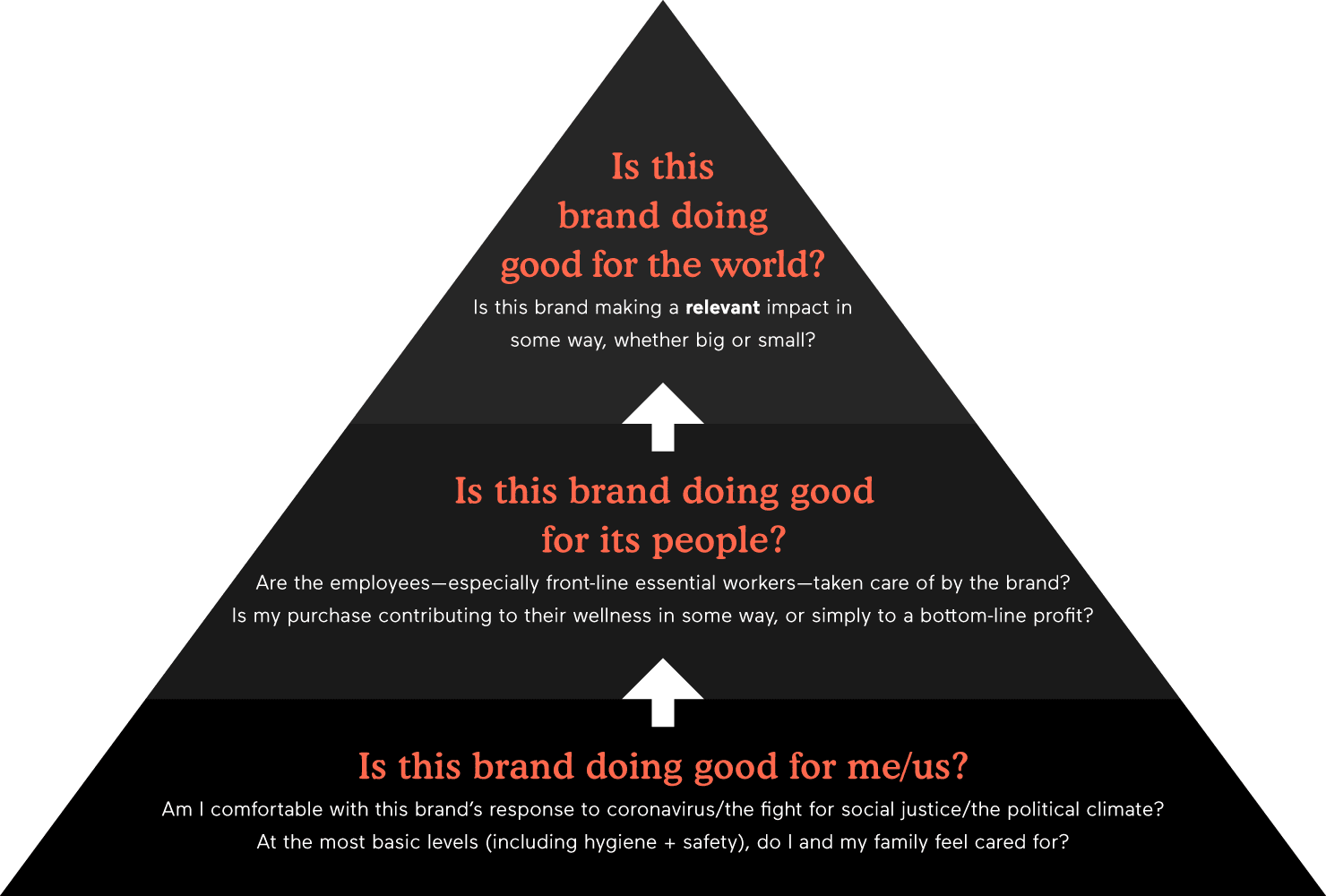

Assuming the basic table stakes of value, availability, and convenience are met, consumers will use a new framework when deciding between brands: Do good for me/us, do good for your people, do good for the world.

Do good for me/us

First, consumers will consider if they and their families feel safe and comfortable doing business with you. At the most basic level, this is fundamental safety and hygiene messaging. Consumers have expressed that they want to continue to hear the steps that brands are taking to ensure their safety—QSRs offering no-contact delivery, retail locations sanitizing pens and card readers, hotels removing unnecessary linens from the room, etc.

Beyond that, in such a politically charged environment, consumers may also evaluate their level of comfort in terms of a brand’s response to political or social movements, like Black Lives Matter, or to which political candidate it’s made financial contributions, or by seeking out other markers of shared values.

Do good for your people

Second, many consumers will look for cues that a brand has taken care of its people during such a tumultuous year. This will be especially true of brands with front-line or essential workers. “We’re all in this together” seems to be the unofficial tagline of the pandemic and its brought many consumers to question what, exactly, their hard-earned money was supporting. Consumers may ask: Did the organization do everything possible to keep its people feeling safe and cared for in 2020? Has it provided its people with opportunities for advancement? Does it feel like it values and rewards diverse perspectives?

Do good for the world

Finally, more consumers will be motivated to see brands doing good in the world—even if that means making a positive impact in small, simple ways. A common criticism of purpose marketing is that it’s not grounded. (For instance, you don’t sell tortilla chips, you sell ‘togetherness.’ Barf.) Consumers see through that today just as well they do a thinly veiled philanthropic message. However, choosing to support initiatives that are relevant to your brand (like, actually relevant) and inviting your customers in to help make a difference can tip the decision-making in your favor.

For example, imagine you’re choosing between two spirit brands that appear to be more or less at parity. Similar price, similar labels, similar reviews. But then you learn that one of those two spirit brands approached 2020 as business as usual. The other created a Covid relief fund to support out-of-work bartenders and live musicians. Which do you choose?

As a result of consumers staying so close to home, there’s also renewed focus on localism and a desire to support the neighbors and businesses that make up one’s community. It might seem counterintuitive that a Fortune 500 brand or (especially) a chain business could authentically respond to this behavior, but then, what if these organizations empowered their local franchisees or management to make more community impact?

The good your brand does in 2021 doesn’t have to be coronavirus related—or really, much of a reach from your core business, either. For instance, I’ve been surprised to see so few outdoor recreation and apparel brands respond to the fight for racial and social justice. Outdoor recreation—and especially visitorship to state and national parks—tends to be dominated by white, affluent families. Outdoor and apparel brands may not be able to directly alleviate the many injustices that so many people of color face in their daily lives, but they could certainly make a difference in increasing equitable access to the outdoors.

Lastly, doing good for the world could also be as simple as expressing messages that promote commonality and unification. With the country so politically divided, most marketers are reticent to convey any message that might be viewed in a partisan nature, and rightfully so. But that doesn’t preclude brands from tapping into the commonalities that bring their customers together, regardless of political beliefs.

- McKinsey & Company, The great consumer shift: Ten charts that show how US shopping behavior is changing, 8.4.2020

- U.S. Census Bureau, American Community Survey, 2018

- VentureBeat; Zoom’s daily active users jumped…; 4.2.2020

- Global Workforce Analytics, Work at home after Covid—Our forecast, 2020

- Think With Google, How restaurants can better assist customers during times of uncertainty, April 2020

- HospitalityTech, Chipotle’s loyalty program explodes…, 4.22.2020

- Savanta, Consumers + Coronavirus Biweekly Tracker, 8.6.2020

- McKinsey & Company; How Covid-19 is changing consumer behavior—now and forever; 2020

- IBM, IBM Study: COVID-19 is significantly altering U.S. consumer behavior and plans post-crisis, 5.1.2020

- Mintel, Covid-19’s economic impact will reshape US consumer behavior and shift market demand, 4.20.2020

- Pew Research Center, Unemployment rose higher…, 6.11.2020

- CNBC, Job losses remain ‘enormous,’ 7.9.2020

- The Washington Post, Pay cuts are becoming a defining feature of the coronavirus recession, 7.1.2020

- Think With Google, The at-home consumer experience with consumption and expenditure, April 2020

- Think With Google, How the pandemic may affect holiday shopping, July 2020

- Mintel, Quick Service Restaurants, including impact of Covid-19, April 2020

- BBC News, Disney+ racks up 50M subscribers in just five months, 4.9.2020

- Variety; ‘Hamilton’ far bigger than anything on Netflix in July, audience data reveals; 8.10.2020

- Tech Crunch, Fortnite hosted a psychedelic Travis Scott concert…, 4.24.2020

- Zeitgeist Research + CMO Consulting Group, Covid-19 impact on consumer attitudes and behaviors, July 2020

- Yahoo! Finance, Teladoc Health, Inc (TDOC) historical stock price, accessed 8.12.2020

- CNBC, As coronavirus pandemic pushes more grocery shoppers online…, 5.1.2020

- Digital Commerce 360, Online grocery shopping soars during the coronavirus, 3.30.20

- CNBC, Walmart and Instacart partner for same-day U.S. delivery…, 8.11.2020

- Reuters, Home gardening blooms around the world during coronavirus lockdowns, 4.19.2020

- USA Today; Adoptions, fosters empty shelter cages during Covid-19; 4.28.2020

- Savanta, Consumers + Coronavirus Biweekly Tracker, 4.15.2020

- RideApart, BMW Motorrad already back on track with record June sales, 7.8.2020